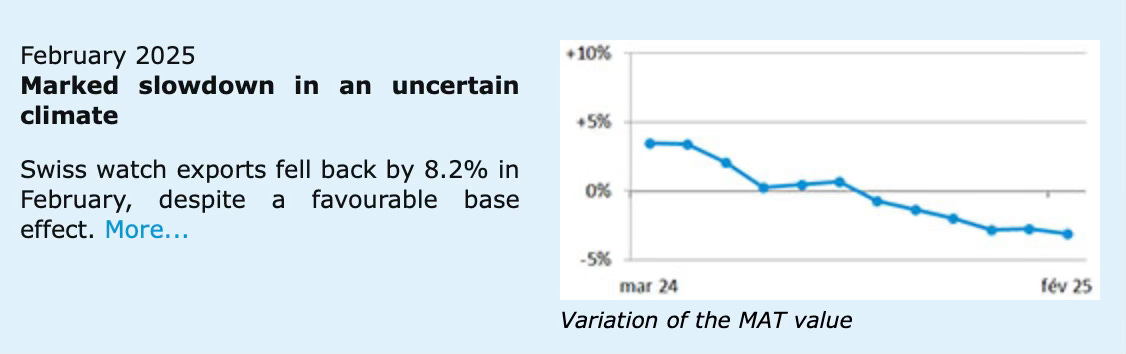

Recently, the Federation of the Swiss Watch Industry (FHS) released their regular monthly statistics on Swiss watch exports. The report is a very convenient summary based on watch export data from Swiss customs (FOCBS). The FHS provides value by eliminating the labor of sifting through the Swiss-Impex database (a big thank you to Jessica at FHS). The report is then repackaged by various jewelry/watch media for general readership. Here is a screenshot from the FHS February 2025 update:

‘Marked slowdown’ sounds somber, especially when accompanied by a graph that seems to be crawling feebly towards a slow death. Hence the comments section of media articles that repackage the FHS data can descend into cynicisms and/or apocalyptic declarations - ‘the bubble has burst! Burst, I tell you!’

These comments stem from the lack of context in the articles and conflation of secondary market price signals with primary. But these are quick updates for short attention spans, not long form analysis, so the authors cannot be blamed either.

To the casual reader, the monthly updates are confusing because they are year-on-year (YoY) figures, a traditional approach to assessing performance. In this update the FHS reported that exports declined by a scary 8.2% YoY compared to February 2023. The problem with YoY comparisons is that it reduces the assessment to a binary - if my compensation is connected to Swiss watch exports, I am either happy (exports increased YoY) or sad (exports decreased YoY). It is not robust to changes in seasonality and submarket dynamics, and cannot differentiate noise vs fundamental changes in the baseline. When comparing annual YoY, we find that total exports in 2024 declined by CHF 755M, or 3% compared to 2023. But if you think about it, annual is also an arbitrary threshold and not really telling us much more than monthly. The monthly export values in CHF millions from Jan 2021 to Feb 2025:

In addition to a spectacular run-up from 2021, I can discern a slight decline in 2024, but the seasonality makes it overall confusing. I would have preferred # of export units instead of values, but we have to work with what we have. In order to make this graph useful, we need to 1. de-seasonalize the data1 , 2. convert to an XmR chart2 and 3. since 2021 was arguably a fluke year, adjust the x-axis to 2022 onwards:

The adjusted X chart depicts exports as trending slightly downwards, but well within its upper and lower limits and still criss-crossing the center (mean) line. 8 or more successive values on the same side of the center line would signal that the time series has shifted (1/128 odds) and is a baseline change. Its not in the graph above, but that is what happened from 2021 to 2022, moving the baseline up.

Growth has been tremendous from 2021 onwards. In fact, most of the 2023-2024 values are above the mean, and we only see some softness in late 2024. Even after Nov 2024 and continuing today, the absolute level of exports is much higher than it was in 2021 or 2022 - indicating that the baseline (the inherent global appetite for Swiss watches) has moved up and remains there. Hence this graph does not support the apocalyptic view that a ‘bubble has burst’ and exports are drastically correcting.

(It is important to note that export values are probably based on previous years’ volume expectations. Hence 2023 exports could be based on rosy 2022 expectations and mismatched to 2023 demand. Unfortunately there is not enough data to model this lag, but it will be addressed below. Btw if you work at an AD, please comment.)

China & Hong Kong

Regardless, there is some softness, and as the FHS notes, it seems to be from China (8% of global exports) and Hong Kong (7%). Here is the time series for China:

It seems that a fundamental change in the Chinese baseline occurred abruptly in March 2024. The new mean is CHF 164M/month, a -28% decline to the prior mean.

I’m not sure if this is related, but the Dec 2021 default and eventual liquidation in Jan 2024 of Evergrande Group and other real estate developers may have had a negative impact on consumption. Crackdowns on financial sector salaries and luxury consumption created a social climate where flaunting wealth became increasingly frowned upon. Social media platforms such as WeChat and TikTok were instructed to limit content showcasing luxury lifestyles. Perhaps the symbolism of Evergrande’s collapse was equivalent to that of the spectacular real estate related failures of Lincoln S&L in the late 1980’s, Hokkaido Takushoku Bank in Japan in the 1990’s, and Lehman Bros in the late 2000’s. (I am not a China expert, so please comment if you have insights on why the Chinese baseline shifted.)

In the interest of brevity I won’t post screenshots of all the country-level graphs, but Hong Kong also entered a lower baseline in June 2024, trailing China by 3 months. The new Hong Kong mean is CHF 30M/mth lower, a 17% decline. Combined with China, that’s an average CHF 93M/mth decrease, or 4.3% of the total world exports. Concerning, but not earth shattering. As of this writing, there is no evidence in the data that the new baseline will be breached. Anecdotally, however, Hong Kong grey dealers have told me that they are pessimistic.

On the other hand, most other countries’ values are still criss-crossing their means, baselines intact. The US market (17% of global exports) is robust, with most monthly export values well above mean and offsetting minor declines elsewhere in the world. As the always insightful

writes, “the death of the almighty (US) consumer continues to be premature.” And as I’ve written before, American tourists are spending on luxury abroad. Speaking of tourists, Japanese market (7.5%) resilience is due to tourist (especially Chinese) demand.So when people make apocalyptic statements about Swiss watch exports, they are extrapolating from weakness in China and Hong Kong. The US, by far the largest market in the world, is very healthy. And any relaxing of hurdles to luxury consumption in China could reignite exports just as abruptly as they were extinguished. The big caveat of course is any US tariffs on Swiss watches.

Exports Vs Demand

But some of you will counter that these are export values to mostly authorized dealers (AD’s), and therefore not indicative of actual demand. And AD’s have long term contracts with manufacturers; it’s not like they can just adjust orders in real time. Isn’t it possible that inventory is piling up at the AD’s, who are forced to buy all this stock but unable to sell due to tepid demand? Maybe they are taking huge losses? After all, we are seeing declines in secondary prices indexes such as Subdial, WatchCharts, etc, and buyers on waitlists are actually getting calls back from their ADs. To complicate matters, some AD’s can sell inventory back to manufacturer.

All these points are valid, but they are not falsifiable with comprehensive, publicly available data - the industry is extremely fragmented and transactions are generally private. Based on my own personal observations at the IWJG shows over the past 2 years, I did notice a slight increase in availability of new product. However, my recollection is that bid-ask spreads were wide, and I did not observe the heavily discounted fire sales that one would expect from a severe inventory glut. But again, those are just my observations in one island of a globally fragmented market.

So were new Swiss watches absorbed by the market, or are they piling up in dealer safes? The only publicly available, somewhat comprehensive data that could hint at the answer are:

# of monthly sale listings of new Swiss watches on Chrono24, dealer websites and public auctions. (Actual sales data is unavailable)

Turnover and inventory levels of publicly listed authorized dealers

1. Chrono24, Dealer, Auction

I was able to download # of monthly listings for new (not pre-owned) watches produced in 2022, 2023 and 2024 from Everywatch3. Over 95% of Everywatch’s historic listing data for watches of those production years are from Chrono24, with the balance from auctions and dealer websites4. The data begins in Oct 2022 and excludes any watches priced <$300. I also filtered out Seiko, Citizen, and Casio. Giovanni at Everywatch tells me that they are also able to provide aggregated listing values and older data, but for a higher membership tier, the cost of which this Substack does not justify. I’ve compiled the data into simple line graphs:

Takeaways:

Based on the trajectory of 2022 (green) and 2023 (grey) production, it seems that 95% of new inventory gets absorbed within 24 months. Generally, listings peak between Sept to Nov of their respective production years.5

When we compare 2023 (yellow line) vs 2024 (grey line) production, there is a significant decrease in 2024-production listings. There were approximately 73K listings of 2023-production watches during the 2023 calendar year, vs only 46K listings of 2024-production watches during 2024. That is a staggering 37% drop.

The narrative is that Swiss watch manufacturers are now focusing on lower volume/higher value product. While this is true to some extent, I don’t think it fully explains a 37% drop; Occam’s Razor tells me that 2024-production is being absorbed by the market faster than 2023 production.

If there was an inventory glut, the 2023 and 2024 time series should reman high. Instead, they are tapering off.

On the contrary, if 2024 gets absorbed at this pace and the total volume of 2025 exports declines, we could see a shortage of new product in the market.

Again, this data is # of listings, not values or actual sales, so there is a significant margin for error. And the term ‘absorption’ may be misleading, as I am using # of listings as proxy. But even then, the primary market doesn’t seem to be in dire straits.

2. Publicly Listed ADs

WatchesofSwitzerland (WOS) is the only publicly listed authorized dealer that I am aware of that publishes detailed financial statements (tells you something about our industry). They also happen to be one of the strongest AD’s in terms of intermediation value to consumers, so may not be representative of the market. But given their scale and breadth of product, they should give us a rough benchmark - if there was a glut, their balance sheet should reflect that with a higher inventory stack.

Based on their annual report for the fiscal year ending in April 2024, book inventory was £393M, a £37M or approximately 10% YoY increase from £356M in FY2003. However, this includes £25.3M of inventory acquired in Dec 2023 as part of the Ernest Jones acquisition and £26.9M in pre-owned watches, mostly Rolex CPO. WOS also booked a £2.4M inventory write-down. If you subtract the Ernest Jones’6 and pre-owned inventory but conservatively add back the full write-down, you get an approximately £12.5M or 3.5% YoY decline in inventory. From their annual report:

Inventory levels increased by £37.3 million (+10%) compared to the prior year. £25.3 million of inventory was acquired as part of the Ernest Jones acquisition, and the Group increased pre-owned watches and Rolex Certified Pre-Owned volume by £26.9 million. This has been offset through a reduction in underlying inventory to maintain stock turn at appropriate levels. The inventory obsolescence risk remains low.

Gross revenue was flat at £1.54B, but if the objective is to look for evidence of an inventory glut, I’m unable to find it in one of the largest multi-brand authorized ex-Asia dealers in the world. On the contrary, based on their acquisitions spree, it seems they are hungry for inventory.

2025 Onwards

Perhaps keeping people at home during the COVID years with free access to online watch media really bumped up the global baseline demand for Swiss watches. Per the latest data, it seems that Swiss watch exports are overall still maintaining that baseline, and not reverting to prior years’. The China/HKG markets are concerning, but as of this writing do not seem to be breaching their new baselines. Although precise data is lacking, we can infer that absorption for new production is strong, and it could turn out that we will see a shortage of 2025 product. If so, we should see an increase in secondary market prices around Oct/Nov this year.

Other than new US import tariffs or a surge in demand for smartwatches, the only tangible threat to new Swiss watches seems to be…other Swiss watches. Or in other words, the secondary Swiss watch market. This market is currently undergoing a major structural change with the introduction of manufacturer authentication programs such as the Rolex CPO. Will CPOs cannibalize new sales and lower the post-COVID baseline? Or just plug shortages? We should find out later in the year.

STL decomposition to break each monthly export value into three components: trend, seasonal, and residual. To deseasonalize the data, I removed the seasonal component by summing the trend and residual. If you are a statistician and you think my methodology is wrong, please dm or comment and I will correct.

The best book on XmR charts is “Understanding Variation” by Donald J Wheeler.

If you are interested in a monthly membership in Everywatch, here is a referral link for 1 month free. But you should first make sure to play around with it and compare with other data providers to see if it fits your needs.

In the regular membership tiers, my impression is that Everywatch is better suited for searching comparables in the secondary market. Customized reports and csv data dumps are unavailable unless you pay for the highest tier.

For 2023 production, listings peaked in July 2023, which is kind of odd but in line with overall sentiment, which was deteriorating at the time.

The EJ acquisition was in Dec 2023, only 4 months prior to the FYE, and we don’t know the inventory composition. Therefore I thought it best to exclude. We don’t know the composition of the write-downs, but I conservatively added it back.

I always assumed that luxury abroad was a combination of conspicuous discount consumption and an arb on the strong dollar (relative the europoors). Luxury is hurting, but you still have to go on vacation (bc of signaling effects) so why not Italy (which is cheap) and do some fancy shopping while you're there. Actually wrote about it once https://www.therandomwalk.co/i/156024996/buying-luxury-abroad

Depending on what you care about, the Swiss export numbers DO in fact paint a somber picture. Over the last 25 years, total export value has roughly doubled, but I think more importantly total export volumes have halved. So in my opinion, no, Swiss watch exports are not doing just fine. I'll share the long-term FHS data I have with you via DM.