About 10 years ago I was part of a 3-man team selling vintage jewelry and watches at the Antiques Show in Las Vegas. I was new to the business and having a pretty rough show, with lackluster sales in the morning of the first day, when most business should get done. In order to make numbers, I started walking the exhibition halls with my wares in hand. A few dealers I knew, but most I had to cold-approach. While there is a mild sense of camaraderie among exhibitors, you will get beat up on price, and most will not have an appetite as they are probably having an equally bad show.

After a couple hours of peddling I started to get quite dejected. I was getting counter-offered by guys in hoodies for 40-50 cents on the dollar, “not buying right now but what else you got”, selling on a razor thin margin in return for a check dated 2 weeks later, and other standard business practices in our industry at the time. My feet were aching from walking and standing at booths so long, I started asking myself existential questions. What was I doing here? Is this the correct use of my time?

In the midst of all this wandering in the desert I found myself in front of Alex Ciani’s booth. His table seemed to glow, an oasis of precious metal Datejusts and Day-Dates of rare and exquisite dial configurations organized beautifully on cushioned display boxes. Soft spoken and dressed casually-elegant in Italian fabrics, Alex was totally different from all the other dealers.

In my hand was a nice specimen of a Tudor “Homeplate” Monte Carlo Ref 7032. A collector’s watch at the time, there was no home for it at the show. I offered it to Alex, who handled it as if it was a newborn, made me a very reasonable counteroffer, and we shook hands. What a gentleman! Given how rookie-disheveled I must have looked, he could have lowballed me, but didn’t. I remember saying to myself, I wish I could only deal with Alex from now on.

So it is with hesitance and respect that I write an unsolicited post inspired by Alex’s beautifully written post on the state of the vintage watch market, which I encourage you to read. I have summarized my views into 15 bullet points. Unfortunately, as is the nature of our industry, comprehensive data collection processes are lacking to be able to quantify and back up any of my claims.

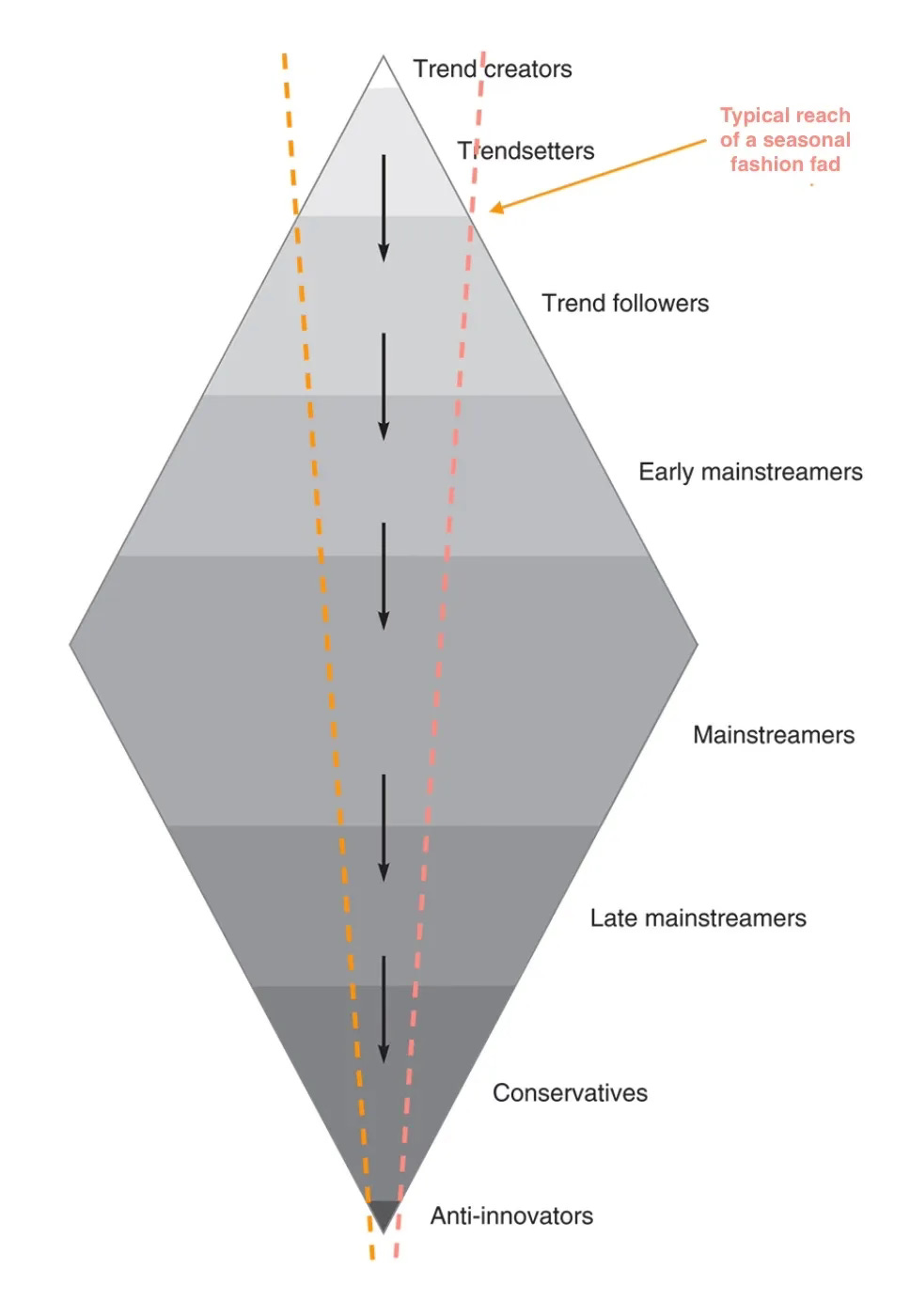

I agree with Alex on most of his views but differ in opinion on some. I hope that some of my claims here help generate discussion so we can all better understand our market. If you are interested in trend analysis, see my post on the diamond shaped trend model and the rise of Cartier Part 1 and Part 3. I’m still overseas and winged this in my hotel room so I’m sure there are some logical inconsistencies, fallacies and errors, apologies in advance.

Prices have come down due to a combination of

opportunity cost of higher interest rates

changing behaviors during and post-COVID forming new trends for smaller, dressier watches produced in smaller volumes

large volume luxury stainless steel sports models running their trend course

lock-in effect due to bid/ask spread of inventory purchased prior to 2022

Passion is still strong and new trends are forming, but for different, lower supply volume watches (vintage Cartier and now Patek Calatravas), vs large supply volume (Rolex Subs and AP Royal Oaks).

These new trends are constrained by the limited supply of these watches; dealers are having a difficult time adjusting product mix so quickly.

There is a significant bid/ask spread between current buyers and those sellers that purchased inventory prior to Feb 2022, resulting in a lock-in effect that somewhat negatively affects turnover. (This is similar to stalled property markets in major cities in the US). Some dealers have switched to consignment-only.

On the other hand, auction houses have proven to be the most agile players, with new online auction platforms appearing that have efficient consignment processes and lower transaction fees to both quickly take advantage of fluctuating trends and find buyers globally for passe models. Results may be down overall, but it’s actually kind of hard to find absolute bargains in auctions. The widening price spread between wholesale dealer price for say a 5513 or 1675 at the IWJG show vs the higher auction hammer prices is probably due to the agility and global reach of auction houses.

Unlike during bear markets of the early 1990’s and post-Lehman period, today we have many established auction and sales platforms and a deeper, better capitalized trading market where distressed dealers and collectors can find buyers for watches globally. Hence I don’t think we will see as many 40-50 cent on the dollar type bargains this time around.

Simultaneously, younger trendsetters, collectors and dealers are entering to spark demand in unconventional and very entertaining ways from both veteran buyers and a newer generation of collectors. The most impressive is Mike Nouveau and as participants in this market we should be thankful for his efforts.

Counter-intuitively, the best way to invigorate the market is for older collectors and dealers to release the hidden gems that they have locked up in their safes. In other words, if you were to ask me whether we have a demand-side or supply-side problem, I would say that (counter-intuitively) we have a supply-side problem. And we are not dealing in widgets.

Note that many watches, even those considered common stock, in strong condition with design elements that are favored in the current vintage watch Zeitgeist continue to break auction price records.

It is difficult to define who is a speculator vs passionate collector. Apart from a small group of diehards that are able to mentally shut out market influences, the majority of us are consciously or subconsciously influenced by price trends. Watches literally look better when prices are high and rising. I also know “investors” that haven’t sold for 10+ years, and on the other hand some supposedly passionate “collectors” that reshuffle their collection monthly. To simplify, let’s crudely define speculators as a group who ‘s primary intent is to profit on trend momentum and as a result have a multiplier effect on prices, as we saw from 2012-2022. We should also separate speculators from regular wholesale dealers, who are in the business for the long term and are the backbone of the vintage watch market.

My view is that speculators’ ability to influence prices in the vintage watch market is non-trivial, but not very significant overall because:

Speculators have difficulty sourcing - most reputable vintage watch dealers don’t supply them with choice product because those watches may never return for a trade/consignment. They can buy in auctions, but that is not a very efficient way to source large enough volumes to influence overall pricing. I’m not even talking about rare Pateks - even investment condition matte dial 1675’s were not so easy to source.

The market is hyper fickle, and so their overall profitability is probably quite mediocre - consistently beating the market is too difficult - and they drop out frequently.

Artificially creating scarcity or investing in pieces while they are relatively undervalued can lead to profit, but just as often can lead to losses and/or opportunity cost. The market can be “wrong” longer than they can be solvent.

Most importantly, for each of their successful trades, there is a counterparty that, based on data that is today freely available on the internet, feels it is a good deal. Usually that counterparty is a collector/consumer with no initial intention to flip (my claim based on anecdotes).

Hence the ratio of “speculator” to “collector” is not as high as often believed. They do exist, are actively culled and replaced, and don’t really go away, but they are a smaller constant that is proportionate to supply. I’m aware of some organized speculators and small funds in Europe (bought from one), however in my 10+ years, I’ve never met a consistently successful Jesse Livermore let alone a KKR of the $5-6Bn vintage watch market.

The main cause of continued rising prices beginning around 2012 and then crazy prices from 2020-2021 are mainstream collectors and consumers with no initial intention to profit, who were influenced by social media driven trends, and got worked up enough to pay a premium to possess a product in limited supply. In other words, the cause of crazy prices is too much social media induced passion, not too much cold speculation. And counter intuitively, it is the watches with larger supply (Subs, RO’s and Nautilus's) that experienced higher multiplier effects, most probably due to ubiquitousness on social media. Low interest rates kept credit cards handy and purse strings loose.

As the trend ran its natural course, trendsetters upstream created new trends, and prices for formerly coveted watches declined. Those over-passionate collectors and consumers did regret their financial loss somewhat, but the most crushing aspect was that their passions were not shared any longer by as many people.

Just as Alex welcomes a plummeting market, I welcome a rising market, but not just for want of profit (although that would be nice too). Its a bit of a chicken and egg situation, but a rising market usually attracts smart, dedicated, and well educated collectors and scholars that cooperate, compile, discover and document knowledge on what would otherwise have been an overlooked or forgotten piece of horological history. This is similar to other “hot” industries such as AI. For example, it is only now in 2024, during the current Cartier trend, that we publicly get a comprehensive breakdown of the confusing Cartier reference numbers and dial types. Nobody that I know ever thought of compiling such a list when Cartiers were considered cheap watches. Another excellent example is the Longines chronograph trend between 2016-2022. During this period, not only did these dedicated collectors and scholars document and make sense of the mysterious Longines numbering systems and dial/case combinations, they developed a working relationship with the Longines heritage department to build a knowledge base that will be indispensable for posterity.

Enjoyed this - will respond in full, and link to this on Wednesday in my newsletter.

One question:

"The main cause of the rising and then crazy prices we saw from 2012-2022..." did you mean 2021-2022?