A&A, Auction Aggregators, and AI

A Brief Look at the $10Bn Auction Aggregator Sector for Arts & Antiques and AI/ML's Eventual Transformation of the Space

The Arts & Antiques (A&A) Auction Market

In 2023, the overall market size for art, jewelry, watches, classic cars, wines and other luxury collectibles was estimated at approximately $400-$500Bn worldwide. It is difficult to reconcile these numbers as a lot of trading is private and there is no centralized data capture process. So please take all numbers with a huge grain of salt.

Arts & Antiques (A&A) is a loose categorization of secondary art, jewelry, watches, furniture and other collectibles. Based on hammer prices and annual reports from eBay and other companies in this space, it is estimated that the total auction market in North America and Europe for A&A is approximately $25Bn. Of this, $15Bn is attributable to eBay and the Big Four auction houses. The remaining $10Bn is attributable to the highly fragmented auction house industry, with an estimated 3-4k auction houses in North America and Europe receiving consigned items to list in online and in-person auctions.

To put this into perspective, the total value of watches listed on Chrono24 is approximately $50Bn. Even if watches made up say 40% of the aforementioned A&A $25Bn auction space, it would still be 5x smaller than a dealer marketplace such as Chrono24.

In essence, auction houses are event planners for consignors and bidders. Christie’s, Sotheby’s, Bonhams and Phillips (the Big 4 auction houses) are well known, have strong clientele, and operate their own in-person and online auctions. They curate well and wow both bidders and consignors with their highest standards of cataloging and photography. Items auctioned at a Big 4 even gain somewhat of a provenance. And their live in-person auctions can be as exciting as a Taylor Swift concert.

However the overwhelming majority of auction houses are small to medium sized businesses with little to no brand value outside their local markets. They gather consignments and invite bidding from consignors in their local markets, who for various reasons are unable or unwilling to consign their item to a Big 4. Consignors are usually individuals, dealers, and sometimes even other auction houses.

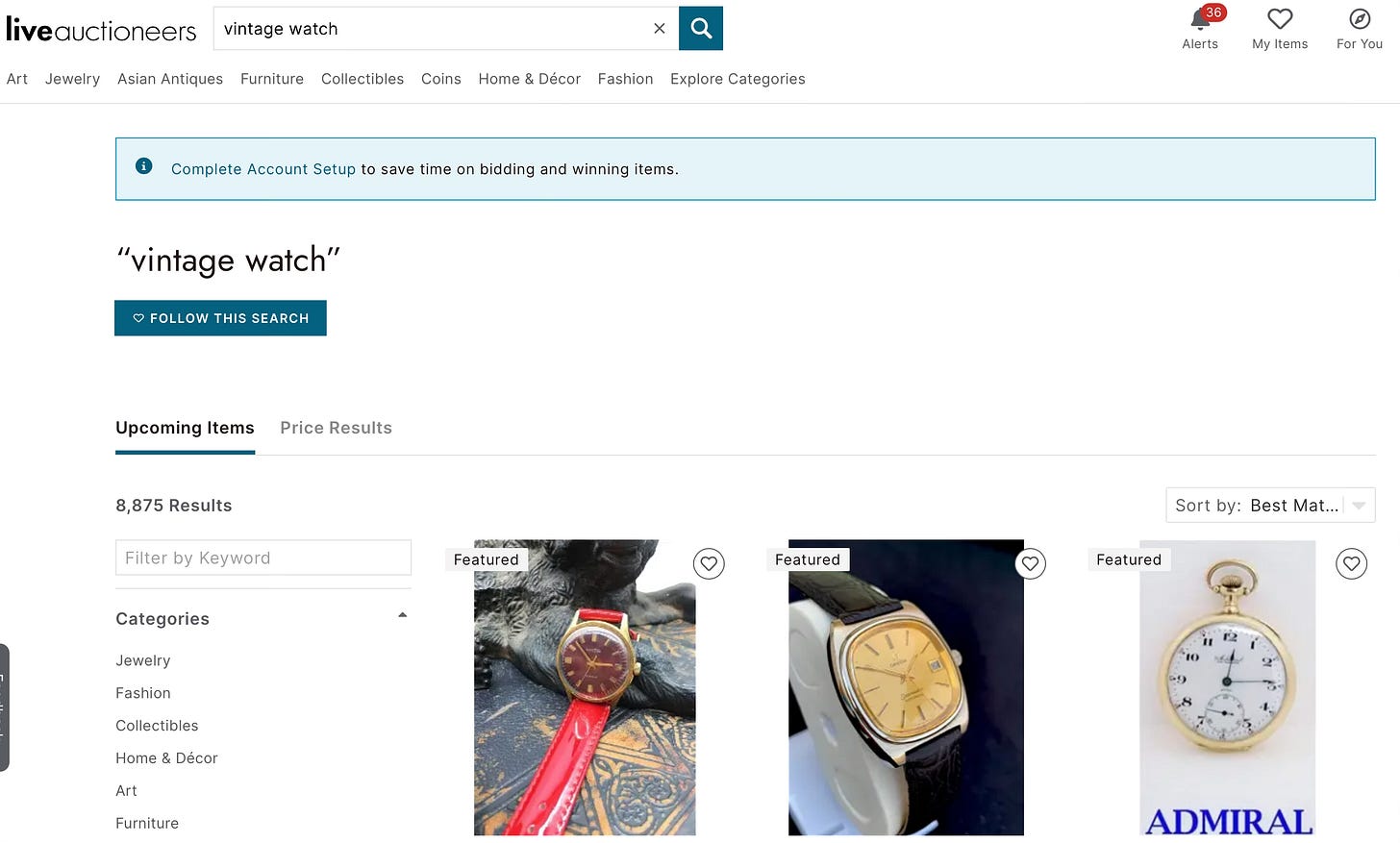

Traditionally, these auction houses conducted in-person auctions on their insured premises, with exposure primarily limited to bidders in their greater local area. This resulted in opportunities for arbitrage for bidders that didn’t mind traveling from auction to auction. However the advent of auction aggregator marketplaces such as LiveAuctioneers led to these formerly local auction houses gaining global online exposure for their items.

The following are the 2 major auction aggregator operators and some KPIs claimed:

Auction Technology Group PLC - 3900+ auction houses with 690K active bidders.

Invaluable, LLC - 5000+ auction houses with 200K active bidders

(Note: there are overlaps, they include non-A&A and none of these numbers can be verified)

For this post we are going to briefly take a look at Auction Techonology Group’s business based on publicly available financial statements for the FYE September 2023. (Invaluable, LLC is privately owned and thus financial statements are not publicized.)

Auction Technology Group

Auction Technology Group PLC (LON:ATG) is a publicly listed auction aggregator, with a wide range of items from jewelry to industrial machinery. From their offices in the Harlequin Building in Central London, they operate the popular LiveAuctioneers marketplace, which I use sometimes to find auction listings for the weekly auction highlights newsletter. Thanks to them, we have the opportunity to purchase rare items in far off lands from the convenience our homes and offices.

ATG is a broker that has some software that enables both live and online auctions for the estimated 3-4k auction houses and 500K+ active A&A bidders in the world. Although headquartered in the UK, 82% of their revenues are generated from North America. A little more than half of ATG’s gross revenues is from A&A, with the balance from Industrial & Commercial auctions (machinery, trucks, etc.) In addition to the auction aggregator marketplace, they also provide some auction houses with software to manage their operations (cataloging, clerking, invoicing, etc).

Due to ATG’s penchant for acquisitions, it’s kind of hard to follow their statements over the years. But thankfully, they at least break out A&A as a separate operating segment (unfortunately they don’t break it down into watches only). For FYE Sept 2023, the total value of all A&A listings on their platforms, what they refer to as “Total Hammer Value (THV)”, was £4.5Bn. Of this, only 17% or £0.76Bn was actually sold, from which ATG generated £65.6M in revenues. So effectively they have a “take rate” of 8.6% which you can loosely think of as how much bidders and auction houses pay as fees to use their platform.

THV grew by only 1% YoY for the FYE20231, so we can surmise that the A&A auction market is stagnant and competition for consignments is fierce. In the company’s own words from their 2023 Annual Report:

Arts & Antiques represents a large, low growth market, driven by demand for a range of categories from furniture, watches and jewellery, to arts and other collectables.

Hence the main driver of ATG’s revenues has been mergers and acquisitions. Over the past 6 years, the company acquired 5 competitors, including LiveAuctioneers. As a bidder/consignor, I still haven’t seen much systems integration over their various platforms, however I do understand and appreciate that integration takes time.

So you could argue that ATG is actually a private equity company masquerading as a software company for auctions. A “take rate” of 8.6% from the A&A segment results in an EBITDA of approximately £50M on roughly £500M in A&A assets (mostly goodwill), so its a 10% internal earnings generator for them and an estimated 15% internal ROCE, which is lower than I would expect for a software company but I guess is ok. (I used EBITDA because they amortize a large amount of goodwill/intangible assets and net income was misleading).

What Do Bidders/Consignors Want from ATG?

The objective of this post however is neither a credit review nor an attempt to give investment advice. Rather, as both a bidder and consignor in the A&A market, I want to point out some areas of improvement and try to understand AI’s eventual impact on this space.

But before I start, I want to say that I appreciate and am thankful for the benefit that ATG and their platform has brought to us bidders and consignors. I hope that anyone reading this takes it as constructive criticism.

In discussing areas of improvement there are 2 metrics that are important to bidders and consignors:

Lower Transaction Fees

Improved Item Discoverability/Curation

Lower Transaction Fees

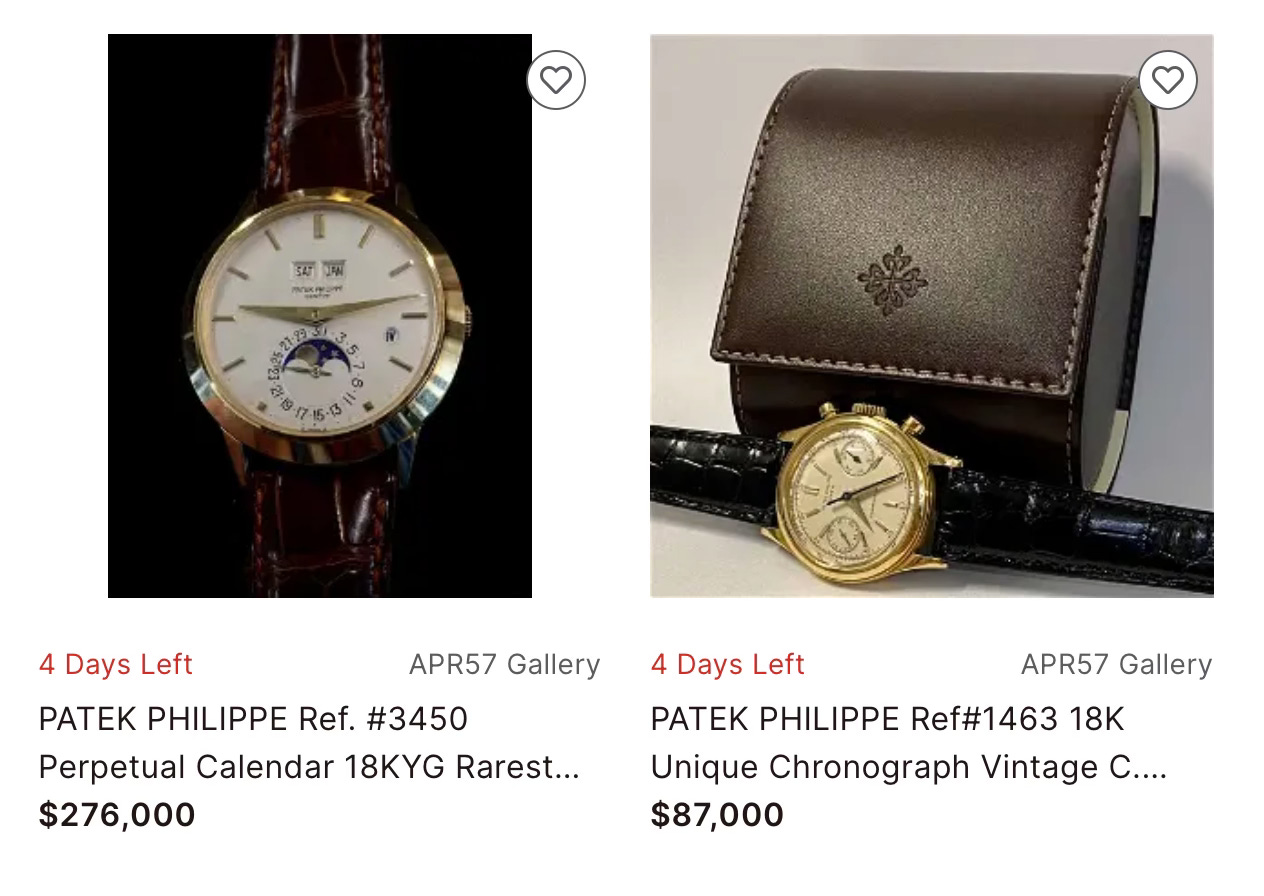

As stated above, ATG’s “take rate” of 8.6% can be loosely defined as how much bidders and auction houses pay to use ATG’s platform. I say loosely because ATG does not provide a breakdown of the take rate. I prefer to purchase directly from auction houses, but if I’m too lazy to register I sometimes use LiveAuctioneers. I don’t have time to go through all my invoices but generally the listed aggregator fee for a one time purchase is in the 2-3% range, so the difference between that and the take rate of 8.6% are fees borne by the consigning auction house, such as advertising/payment/shipping fees, and website subscription fees. Premiums that bidders must pay on hammer price to the auction houses is 20-30%, so winning bidders on auction aggregator sites pay a whopping 22-33%2 in transaction fees, and consignors pay approx. 4-6%, resulting in a net transaction cost of approximately 18-28%. And as I have mentioned many times in my auction highlights, the level of cataloging, photography and expertise of many auction houses can be quite subpar.

Let’s compare this to eBay, where the total final value fee is usually 15% for most irregular sellers and slightly lower for high volume sellers (usually no fee for bidders). Some argue that because eBay neither conducts in-person auctions, nor curates, nor catalogues, higher fees for auction houses and aggregators are justified. After all, eBay and auction houses have been coexisting for more than 2 decades.

But now let’s compare with online auction newcomer Loupe This. I wrote about my excellent experience with Loupe This last week. Loupe This’s premium on hammer is a flat 10%, and their listings are superbly curated and catalogued by 2 well known and trustworthy experts. Again you could argue that Loupe This’s auctions are online only, but according to ATG’s own reports, online bidding’s share is growing at 19% CAGR and now at 40%+ of all bids. Do consigning auction houses and aggregators really deserve the transaction fees they are charging?

The largest portion (the 22-33% premiums) of the transaction fee is due to the fragmented and hence inefficient nature of the consigning auction industry, which can only be improved by consolidation (lower insurance and venue fees, etc). But what about ATG’s take rate? On page 17 of their annual report, they write that they want to improve the take rate by:

Continue to grow the usage of marketing solutions

Grow the adoption of atgPay across marketplaces

Roll out atgShip, starting on LiveAuctioneers

So they want to increase transaction fee revenue by inserting their own shipping and payment systems, plus more advertising. These are important, but not high value added services that justify the transaction costs. After all, couriers such as Fedex will be shipping the items, innovative payment systems such as Stripe exist, and advertising adds to clutter. Personally I even had problems with atgPay when using AMEX cards. What do bidders (and consignors) really value?

Improved Item Discoverability/Curation

Perhaps I’ve missed something, but LiveAuctioneers and Invaluable’s websites have not changed much in close to a decade. It’s actually become harder to search for items due to the increase in lower quality and duplicate listings. Although it’s difficult to identify metrics, I feel that discoverability of items is declining. (If discoverability was high, there would be no need for this Substack). The closest measurable metric I can think of is the conversion rate - if discoverability is high, then more listing would convert to sales. It’s a stretch but let’s work with what we have.

For the FYE September 2023, the conversation rate for A&A was a pretty mediocre 17% of all items listed, a 3% decline YoY. A watch dealer would go belly up quick with that kind of rate. So how is ATG expecting to improve the conversion rate? Let’s go back to page 17 of their annual report:

Actively encourage auctioneers to shift to timed [online] auctions

Continue to grow penetration of atgPay

Roll out atgShip

Hmmm, that sounds almost exactly how they want to improve the take rate. And here is a comment from CEO John-Paul Savant:

We have continued to make investments which we expect will help to grow our conversion rate in the medium term. On the bidder side, we have improved our search engine optimisation through a revised site navigation and site taxonomy, as well as new lot-focused category pages that help bidders to find what they are looking for more easily. Since the launch of these pages in the fourth quarter, GMV generated from search engines has increased by 12%. We have launched new SMS programmes…which helped to drive over 100,000 bids placed from a SMS reminder. On the seller side, we have continued to facilitate the shift to timed online-only auctions including through updated pricing structures, that create economic incentives to switch to a timed auction format. …From a product perspective, we know that many auctioneers want to retain their own brand presence whilst running a timed auction. Through our integrated bidding programme, we offer Timed+, the unique ability to run a timed online-only auction on our marketplace and simultaneously on an ATG white label.

If they have improved search engine optimisation, I haven’t felt it. Optimisation would be based on descriptions, categorizations and photos that auction houses upload, but as aforementioned many auction house have a limited understanding of the items they are cataloging. And different auction houses use different auction management software, so I’m not quite sure how they envision integrated bidding. SMS reminders and pushing for online auctions are nice, but not quite cutting edge technology in 2023 and probably something that should have happened many years ago. Personally I turn off SMS reminders anyway.

Granted, improving discoverability is difficult. Algorithms work somewhat, but are constrained by the often subpar photos and descriptions entered by the auction houses, and complicated further by advertising. And as more items are listed, it gets more difficult for bidders to discover items of interest, leading to fatigue. This inadvertently penalizes auction houses that write thorough descriptions and take professional photos. Authentication is also always an issue, as currently it is dependent on experts.3 So one of the better ways to improve discoverability is to curate and list less items. Decrease the total number of listings (the £4.5Bn THV) to increase the conversion rate. Erase “zombie” listings that consistently don’t hammer, or listings with high start prices that are in reality not auctions. Discourage high reserves. Since most auction houses have little brand value and struggle to curate, identify and hire trustworthy collectors and dealers curate. Standardize photography and descriptions. Today, all of these suggestions may be difficult to do, but things will change rapidly with artificial intelligence.

AI (and Machine Learning) is Coming

I searched ATG’s 165-page annual report for the words “AI” “LLM” and “Artificial Intelligence” and was happy to find 2 instances:

We are leveraging AI solutions, leading to improved personalisation for our users in several products. Going forward, we are looking to expand the use of AI, including image recognition and generative AI to support lot descriptions.

We are exploring AI solutions and how they can lead to increased personalisation for our users, better descriptions for our sellers, and better service provided by ATG

So when they are not thinking about SMS reminders, ATG’s CTO/CPO is thinking about AI solutions, which I think is great. They seem to realize that AI can provide better service to us bidders and consignors primarily by using AI’s image recognition and generative abilities to improve descriptions, which is necessary for better categorization. And this will result in overall improved discoverability as discussed above (I guess what they mean by “personalisation”).

I’ve written about how I think AI and machine learning will affect vintage watch trading before, so will not go into details again here. And I’m sure ATG’s young blue t-shirt army is much more tech savvy and forward looking than an old watch dealer like me.

But to me, AI’s are not just convenient description generators. They will completely transform the application layer. Large swathes of schema-heavy apps (such as LiveAuctioneers) will be replaced by powerful schema-less, specialized applications that can communicate with each other using strings of natural language. ChatGPT may confuse you into thinking that LLM’s are just a better way to search for things, but they are also actually the backend pipe that allows communication between apps.

In addition to generative AI for better listing descriptions, I have my own list of how I expect AI to affect auctions in general, including:

LLMs that can clerk, invoice and perform administrative tasks

AI agents that can screen listings

Multi-modal ML models that are able to authenticate

LLM-based curators

Trend analyzing AI agents

AI agents as automated bidders and consignors

Looking forward to how auction aggregators such as ATG plan to transform themselves in the inevitable age of AI that is now already upon us.

It’s hard to assess organic growth of THV because ATG has acquired 5 competitors in 6 years and detailed breakouts are not available. Also, the general slowdown in 2022/2023 may have had a negative effect.

Note some regular bidders negotiate fixed monthly fees instead of these premiums.

Invaluable acquired Artymyn, a specialized 5D scanner operator that helps auction houses and bidders authenticate artwork.

What a fascinating and illuminating read! I’m curious where you think auctions aggregator Every Watch fits in this landscape?

Very thoughtprovoking read. Go fig, George - I enjoy your writing about watch auctions _and_ tech-driven disruption of watch auctions.

> Large swathes of schema-heavy apps (such as LiveAuctioneers) will be replaced by powerful schema-less, specialized applications that can communicate with each other using strings of natural language. ChatGPT may confuse you into thinking that LLM’s are just a better way to search for things, but they are also actually the backend pipe that allows communication between apps.

> In addition to generative AI for better listing descriptions, I have my own list of how I expect AI to affect auctions in general, including [...]

I agree with you that large action models represent a significant opportunity area for AI, including apps like Vercel's [v0.dev](https://v0.dev/) and [the Rabbit r1](https://www.rabbit.tech/), but this currently represents a significant unknown area. Governance will be critical. Imagine if two interacting LLMs send invoices to a "George T." instead of a "George H.," such that a well-known Star Trek actor begins receiving checks for your vintage watch auction sales? ATG could easily solve this with human intervention, but such a solution limits potential labor cost savings.

On the other hand, I suspect AI will apply very successfully to authentication and screening if standardization can take place. A joke in today's tech industry states that folks considering AI applications should reflect on whether they'd accept the work product of 1000 interns tasked on a single problem. That's far more acceptable for authenticating vintage pieces from Omega and JLC than, say, issuing invoices and payments. Build a strong image recognition app using expert-curated media (dealer images and videos, say), sell access to your authentication API per call or at a monthly rate, and send your clients a lightbox and clear guidance for taking photos. Voila - you've saved millions in costs through less grunt work at auction houses.

Discussion of innovation through software has reached cliche levels, but monolithic companies with aging tech like ATG are often ripe for disruption by modern software. I feel it's far more likely that various aspects of ATG's business are unbundled into horizontal, cross-cutting capabilities (eg. listing aggregation and recommendations through algorithmic curation, lot authentication via image recognition, and inventory sourcing through automated financial operations) than ATG catching up in this area.