Please click “View Entire Message” if reading from email. From “Luxury is Back in Fashion”, Taylor Bowley, Bank of America Institute, via the excellent

:

Bank of America aggregated credit and debit card data shows luxury spending has been declining in the U.S. for 10 quarters year-over-year (YoY). However, it appears luxury spending has finally started to improve and there are signs of early green shoots heading into 2025.

To date, when U.S. consumers do spend on luxury, they appear to have been doing so increasingly abroad. Bank of America brick-and-mortar card data shows 13% of luxury spending was outside of the U.S. in 2024 — up compared to both 2023 and 2019. Perhaps unsurprisingly, this trend was particularly notable among the top 5% of households by income, with 10.5% growth YoY.

Consumers have also been foregoing luxury goods spending in favor of luxury services. Spending on high-end hotels has outpaced luxury retail spending across all generations, though with older generations outperforming younger cohorts.

The report is based on BofA’s private credit and debit card data, so it’s probably very reliable. There is no breakdown of luxury spending by product, but given the number of American tourists I see at pre-owned luxury retailers abroad, I assume that high-value pre-owned watches, jewelry and bags are a non-trivial part of the composition.

This strength in luxury spending abroad could continue if consumer travel demand and “revenge spending” behavior carries into 2025 (see: June Consumer Checkpoint), especially in regions like Europe, which is one of the most popular shopping tourism globally and with the American consumer, per BofA Global Research. Plus, a strong dollar could prompt increased luxury purchases abroad.

So if you are a brick and mortar pre-owned luxury goods retailer in Europe or Japan, you should do your best now to stock up on inventory and advertise your operations on social media to American tourists ahead of peak tourism season. A strong dollar and any new tariffs on luxury goods imported into the US would work in your favor.

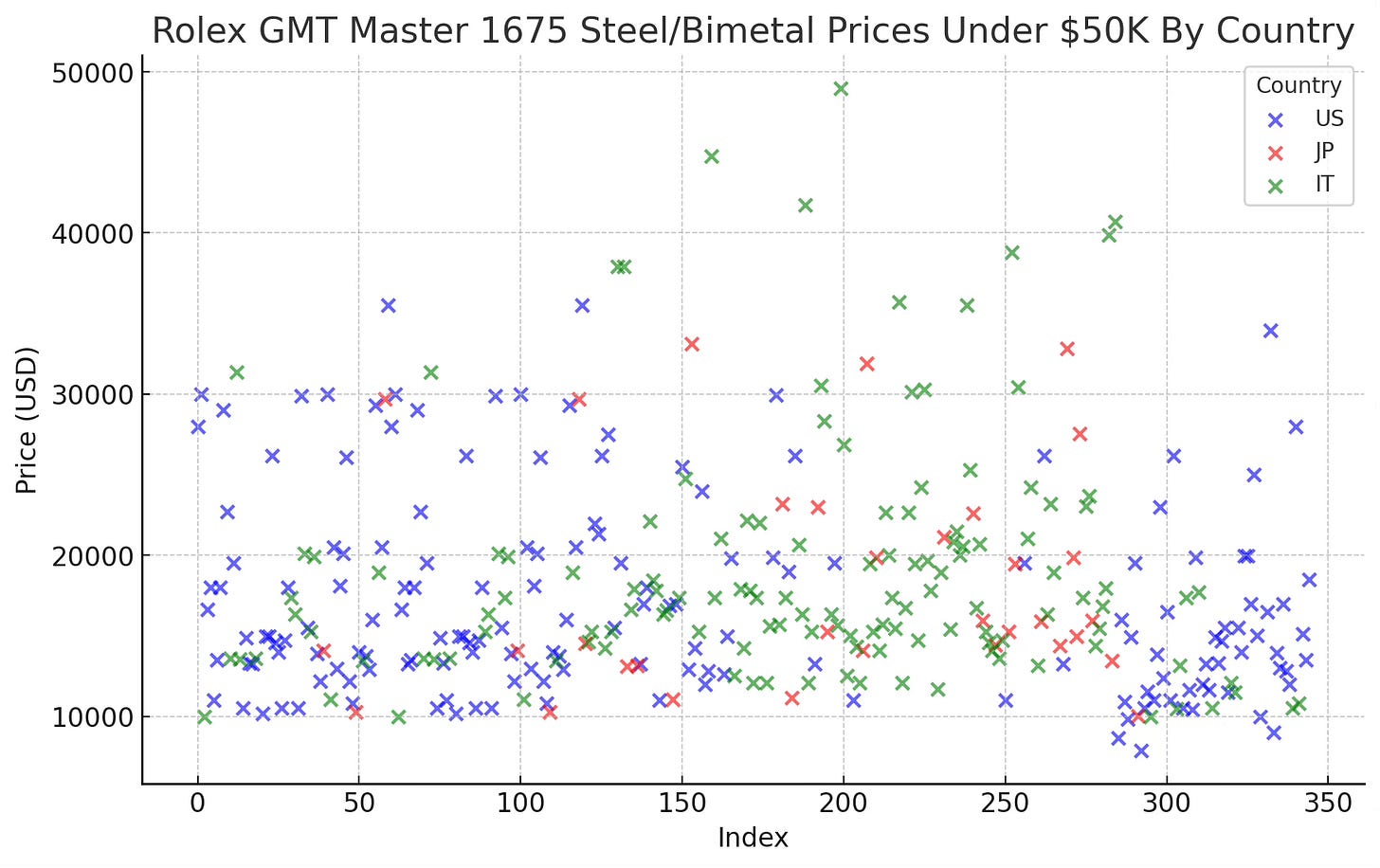

Ironically, a non-trivial amount of pre-owned luxury goods these tourists will buy would have originated in the US (exported out by dealers like me or imported by European dealers visiting the Miami shows). And even after accounting for a favorable dollar and VAT refunds, it’s hard to find bargains at European and Japanese pre-owned luxury retailers1, not to mention competition from well-heeled Chinese tourists. In fact, you could probably find them cheaper in the US, especially if shopping online. So why are these tourists splurging abroad?

As far as I know, no survey was done asking them why they are spending abroad vs domestically in the US. I speculate that in addition to a favorable exchange rate, the reason is better 1. retail agglomeration and 2. experiential consumption abroad.

Retail Agglomeration

Luxury retailers in for example the compact Ginza shopping district in Tokyo (and similarly in major European cities) benefit from retail agglomeration, a concentrated shopping environment where pre-owned luxury goods such as watches, jewelry, and bags are all located within walking distance of one another. The volume of supply you can find in the less than 1 sq mile area that is the Ginza shopping district is astounding, outclassing by several orders of magnitude the walkable Rodeo Drive district in Beverly Hills. This clustering of retail allows tourists to explore and compare a wide selection of luxury goods efficiently, without the hassle of extensive intra-shopping travel. In some Ginza stores2, mom can browse bags while dad marvels at Rolexes, all in the same building. The experience is more immersive and experiential, and reinforces the prestige of the shopping district itself. Safe and efficient public transportation to access these districts as well as proximity of cafes, dining and sightseeing options are also a key factors.

In contrast, luxury retail in most U.S. cities (NYC and Las Vegas may be exceptions) is often dispersed, requiring effort to visit multiple stores, whether by car or public transportation. This dispersion is due to what

calls the geometry problem, where car-based infrastructure is space-inefficient. This makes the luxury shopping experience less efficient and more intermittent compared to the cohesive retail ecosystems of Ginza, London, or Milan.

Retail agglomeration doesn’t just enable retail selling. It also enables the sourcing of pre-owned luxury product from the public. For example, in Japan, anywhere from 40-75%3 of inventory of major pre-owned luxury goods retailers is sourced from individuals looking to liquidate. Most will have a dedicated purchasing section on their premises, where valuations are performed either on-site or remotely by a valuations team at headquarters, depending on value. Most will also have online purchasing and valuation services, but a physical assessment is usually required for higher value items. Sellers also seem to prefer bringing items in to several retailers for valuations.

Larger retailers will also have a network of kaitori, or specialized purchasing shops, throughout the country. Unlike retail or pawn shops, kaitori have no inventory to sell. The interiors are usually clean and modern4, and staff are well dressed and retail-trained. Importantly, kaitori are located in densely agglomerated areas such as around train stations or in commercial districts in primary, secondary, or even tertiary areas. Within an hour, you can get 2 or 3 price quotes from different kaitori for dad’s old Omega and the Chanel handbag that mom is not using, and usually they will be located within walking distance of home, cafe, bank, post office, etc. No need to drive to a pawn shop and negotiate directly with the gruff owner. This enables an efficient cycle of consumption, liquidation and replacement consumption.

Some Japanese pre-owned luxury retailers have attempted to replicate kaitori in the US, but so far have been unsuccessful, due to a combination of cultural differences, capital constraints and the aforementioned geometry problem. In continental Europe, you will find a growing number of kaitori-style purchasing shops in commercial districts, usually advertising themselves as gold buyers.

Experiential Consumption

Consumers increasingly place value on luxury experiences and services such as high-end hotels. This could also mean that a luxurious consumption experience is valuable and possibly a prerequisite to consumption. For example you could visit the jewelry centers in downtown New York and Los Angeles, but they would lack the refined ambiance of European and Japanese pre-owned luxury stores and boutiques. In contrast to the lavish interiors, discreet service, and staff impeccably dressed in sharp suits (often with white gloves in Japan) these jewelry centers will tend to feel more transactional and utilitarian, less experiential. The same can be said for online shopping - comparing prices and scrutinizing photos on different websites is generally not much fun; Fear of scams, overpaying, fakes and shipping problems can make it downright stressful. Physical proximity to the luxury good being purchased thus seems to be important. (Maybe tangential, but one of my Japanese retailer customers told me that many foreigners buy from his shop rather than in their own countries because they think that Japanese retailers are more trustworthy and transparent when it comes to authenticity and condition.)

This could change in the future with companies such as Japanese pre-owned luxury goods giant Komehyo5 and UK retailer WatchesofSwitzerland (nice review by

here) entering the US market, and bringing with them their respective Japanese and European retail expertise. WOS is far ahead of Komehyo, already operating 56 retail locations in the US, and as most readers of this Substack are aware, own Hodinkee and AnalogShift. Despite their name, WOS is not just a luxury watch retailer - their $490M inventory stack also includes high-end jewelry and pre-owned watches. Jewelry brand Roberto Coin is now a wholly owned subsidiary, and Rolex Certified Pre-Owned program is becoming the group’s second biggest luxury watch brand. From WOS’s FY24 annual report:US retail distribution is in the process of consolidation towards larger showroom formats in major shopping centres and retail investment from the Watches of Switzerland Group and others has increased. The US market is predominantly domestic, although domestic tourism (e.g. to Florida or Las Vegas) is significant. In recent years Rolex, Patek Philippe and other brands have been rationalising distribution, reducing the number of agencies to a smaller number of higher quality retailers.

The word “showroom” appears 328 times in their annual report, and the CEO believes it is a key area of expertise:

Over the year, we have continued to invest for high quality growth across showroom projects and strategic acquisitions, whilst building resources and infrastructure within our US business. We have made excellent progress on our showroom expansion and refurbishment programme, with 22 new showrooms opened and 15 refurbished. Our showroom design is a key part of our client appeal, where we focus on welcoming, browsable, modern showrooms. In the US we opened 2 multi-brand showrooms in American Dream, New Jersey and One Vanderbilt, New York. We also relocated our Mayors Dadeland, Florida showroom and expanded the Rolex Millenia mono-brand boutique, Orlando.

US revenue increased by +6% year-on-year (+11% on a constant currency basis) and the US business made up 45% of the Group’s revenue in FY24 (FY23: 42%). Underlying growth was strong across all locations with continued consumer appetite…New York and the Wynn Resort, Las Vegas performed particularly strongly.

One of our key strengths is client experience, which is underpinned by our ‘Xenia’ client service programme. Xenia is heart of everything that we do and is based on three pillars Know Me; WOW Me; Remember Me.

Group e-commerce sales declined by -11% compared to the prior year, impacted by the mix of products sold through this channel and performance of the UK market

And from WOS’s H1 FY25, regarding pre-owned and vintage luxury watches:

Following the launch of Rolex Certified Pre-Owned in the prior year, the pre-owned category continues to grow. Certified Pre-Owned and vintage is performing strongly, with Rolex Certified Pre-Owned becoming the Group's second biggest luxury watch brand. The range of product offered in showrooms is significantly greater than our competitors and has enabled strong growth in the period with further opportunity to expand the category through merchandising and advertising. We are looking forward to the introduction of Rolex Certified Pre-Owned window displays and in-store formats. Rolex Certified Pre-Owned is currently available in 24 agencies in the UK, 19 in the US, and online.

Consumers still seem to value seeing and handling luxury goods in luxurious showrooms; It seems to be an important aspect of experiential shopping, and may even spur it. While it may not be possible to replicate the dense retail agglomeration of Ginza and London in US cities, building luxurious, multi-product showrooms with professional staff that keep consumers engaged with an overwhelming amount of inventory, and without the distractions of intra-shopping travel (and parking meters) seems to be key. Although US luxury spending overall remains cautious, there seems to be a tremendous opportunity for retailers like WOS that can aggressively invest in large showrooms in easy access mixed-use6 retail districts in major US cities.

For new luxury goods, purchasing abroad could be cheaper - prices are capped at MSRP, while pre-owned luxury goods could be marked to global market. Also, if you live in a high sales tax state like California, overall its probably cheaper to purchase abroad.

Most pre-owned luxury goods retailers in Japan have reported double or triple digit annual retail sales growth in the past several years, buoyed by inbound tourism.

Depends on the retailer, with the balance from b2b trading, which includes imports. Komehyo reported that 75% of their inventory is purchased from the public. However these figures include cheaper or damaged goods that are not fit for retail to consumers. The real percentage of resale-able luxury goods sourced from the public is probably in the 40-50% range. By the way, Komehyo now owns Shellman, a well known Ginza vintage watch retailer and the authorized distributor of Philippe Dufour.

Kaitori shops buying luxury goods will have more luxurious interiors and better trained staff vs iPhone or electronics kaitori shops.

Komehyo and some other Japanese pre-owned luxury goods retailers have experience selling in the US market, mostly in the b2b trade. They attend the IWJG shows. Retail results are mixed and most tend to focus their overseas retail expansion in Asia, due to similarity in culture and degree of retail agglomeration.

Preferably with adjacent dining and tourism options.

Hey thanks for mentioning my article. Very interesting thoughts on the US market.

I guess this reinforces my conviction on the company as they provide a great experience with their multibrand stores. Thanks for sharing!

I think having a great store with full of inventory and good employees is important. These things are hard to sell if the customer doesnt have a good experience.