Trouble at Chrono24 Part 1

This is a 2-part series. All of the information in this post is public, and is mostly based on Chrono24’s FY Jan-Dec 2022 financial statements, the latest that are publicly available. No private or insider information is contained in this post.

On Sept 4, Chrono24 announced a new fee structure for sellers on their platform.

With the new fee structure, Chrono24, an online marketplace, is in some instances earning more on the sale of a watch than a seller, who takes inventory risk. These fees are a combination of a monthly listing fee and commission rate on sales. While some fees for the largest accounts may have decreased1, the majority of the 3000+ sellers on Chrono24 are small to mid-sized businesses in lower fee brackets where cumulative fees have increased.

For example, the monthly listing fee for up to 25 listings (the lowest fee bracket) jumped from 89 euros to 199 euros, a 124% increase. Chrono24 automatically “upscales” a seller into a higher fee bracket if the average number of active listings exceeds the price bracket listing limit by more than 10% for 2 consecutive months. In a soft market, turnover slows and could naturally lead to being upscaled. Seller margins are often in the single or lower double digits, but commission rates for most price brackets have changed to a fluctuating rate, usually above 6.5%, and in some cases 10%2. The calculation method of the fluctuating commission rate is undisclosed, and is set at the discretion of Chrono24 via their Revenue Calculator, or communication from a relationship manager. Operationally, this results in unpredictable P&L planning for sellers.

Chrono24, however, has the right to increase prices to maximize their profitability or any other metric as they see fit. And price hikes are not inherently bad, especially if they lead to salient improvements in the platform. After all, if sellers aren’t satisfied, they can move to a different platform, can’t they?

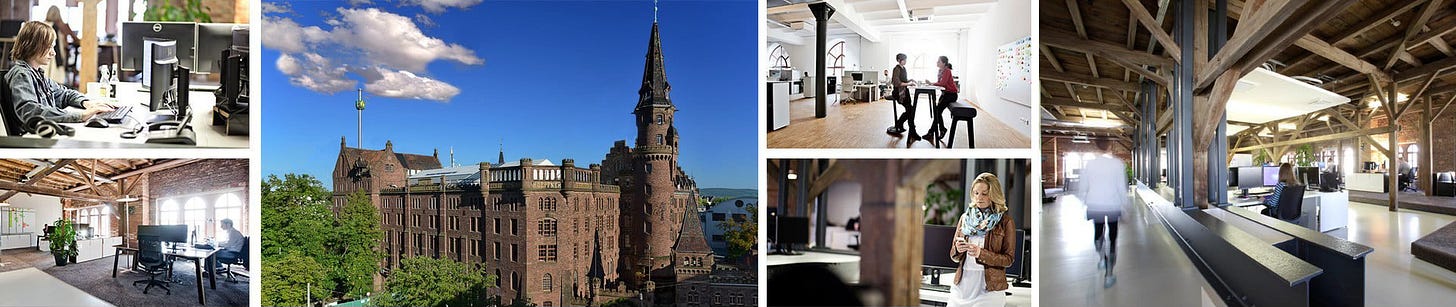

The reality is, Chrono24 (established in 2003, headquartered in a 19th century castle in Karlsruhe and employing 500+ people) has a dominant, near-monopoly position in the online luxury watch market3. They are typical of businesses generating monopoly cashflows - their platform looks and functions virtually the same as a decade ago. It is essentially the best known online luxury watch platform with an escrow service (formerly named Trusted Checkout, now Buyer Protection) and an excellent search and listing function. What it lacks for in innovation, it makes up for in user inertia and investing in good ol’ SEO, always coming up first in Google searches.

Speaking of monopolies, I’m reminded of US cable company TCI and its onetime CEO John Malone. Malone saw no quantifiable benefit to improving his cable infrastructure unless it resulted in new revenues. This was to the detriment of customer satisfaction and the many rural users who experienced horrible service. He was the last to implement new technologies, perfectly happy to wait for his pioneering industry peers to struggle to prove their technical and economic feasibility. Malone focused strictly on cash flows over capital expenditures, and growth via price hikes and accretive acquisitions4. He practically invented EBIDTA as a cashflow metric. This no-frills, EBITDA maximization strategy resulted in a compound return to TCI’s shareholders of a phenomenal 30.3%, compared to 14.3% for the S&P 5005 over a 25 year period.

Unless regulated otherwise by anti-monopoly laws, Chrono24, like TCI, reserves the right to conduct their business any way they see fit. However a key managerial difference between TCI and Chrono24 is that the latter invests their cashflows into ambitious and capital intensive projects and acquisitions, including direct sales of inventory on their books. Unfortunately, many of these projects have either failed, were dilutive to earnings, or turned out to be mediocre. Based on the latest financial statements available for the FYE Jan-Dec 20226:

€6.1MM in on-book inventory impairment

€5.0M goodwill impairment on acquisition of Xupes

€3.9M impairment from acquisition and subsequent divesture of ZeitAuktion

€5.2M cash investment in new company buildings

€20M investment in marketing - strong SEO but where are they on social media? Was anybody aware of their “Fathertime” series? How influential is their Youtube channel?

I’m also unsure what happened to or how beneficial these projects were/are?

Virtual Showroom?

Finejewels24.com?

Acquisition of 75% of Fratello Watches?

Chrono24 Appraisal Tool is just calculating the simple arithmetic mean of 2 previous sales of the same reference?

Chronopulse?

The consequences of the above are reflected in their -€22M negative net income for FY2022, ramming down their equity capital by a whopping -33% to €45.6M. EBIDTA remained positive at €9.4M, (buoyed by monopoly cash flows and because impairments are non-cash expenses), but was down -20.5% YOY.

Granted, Chrono24 does core things well:

Optimize SEO to appear at the top of Google searches

A centralized, global, and easy to use marketplace for buyers and sellers

Buyer Protection escrow service, introduced back in 2016. Although by no means high technology, controlling payouts to sellers is an important function that helps confer comfort for its recurring buyer base.7

And on April 2024, after 20 years in the business8, Chrono24 implemented an Authentication Program to authenticate watches by vetted watchmakers. Judgements about authenticity are highly dependent on the knowledge and expertise of the authenticator (what happens if they mistakenly damage a watch or authenticate a super-clone?), but perhaps they have a solid vetting process. Interestingly, authentication of watches between $1000-$5000 is optional and often subject to a $200+ additional fee (ie 4-20%), payable by the buyer.

Now let’s go back to the financials. Stripping out the disastrous direct sales business, Chrono24’s core listing and commission fee platform business generated €83.8M in gross revenues for FY2022. Although a breakout of operating expenses solely for the core fee business was unavailable, I estimated it to be about €77M9 (of which a staggering €41.4M was personnel costs). I could be wrong and happy to be corrected, but if I’m in the ballpark, that’s an operating margin of 8%?, which is respectable but not exactly exciting. Also worth noting is that for 2 consecutive fiscal years, Chrono24 has reported €50M+ in its cash position. A significant portion of this cash balance is from a €75M Series C funding round in 2021. Cash is great, but if I were a Series C investor I’d like to see it invested more productively, perhaps in the development of some advanced technology that would revolutionize the luxury watch trade.

In 2022 alone Chrono24 spent €15.1M on ‘product and technology’ costs, which included provisions for fraud protection, optimizing checkout funnel, social login, machine learning for customer behavior analysis, enhancement of the search and payment processes, and addressing sales leakage, etc. They especially take sales leakage seriously; a simple question about a listing sent to a seller via their platform will lead to incessant popups asking you whether you completed the purchase. Although details of these investments in technology are thin, they did highlight in their FY2022 financial report that the “automatic calculation of delivery times was improved, which enabled more accurate predictions to be made.” Chrono24 also stated that they outsource their payment infrastructure to 3rd party providers.

And as a company that has finished its Series C funding and also has a substantial employee stock option program, the pressures of having to IPO are probably growing. Note that in addition to the €180M in cumulative Series A through C seed fundings since 2015, they secured investments from footballer and avid big watch collector Christiano Ronaldo in 2023 and 26-year old Formula 1 driver Charles LeClerc in 2024. Details of these investments are undisclosed, but Chrono24 did announce the following:

Cristiano Ronaldo joins the likes of previous Chrono24 investors including Bernard Arnault’s family investment company, Aglae Ventures, General Atlantic, Insight Partners and Sprints Capital – who together led Chrono24’s Series C round in August 2021, worth $118M USD (100M €) and solidifying the watch market’s unicorn status with a valuation today exceeding $1B USD.

If they are really valued at $1B, that would be 12x on aforementioned gross core platform revenue of $83.8M and 6.5x on total gross revenues (includes direct sales) of €153M. For context, Amazon and Apple were at 1.9x and 5.6x respectively on revenue in 2022. Chrono24’s FY2023 financial reports are not publicly available yet, but in light of their failed direct sales adventures and a stubbornly soft watch market, we can surmise that their only way to increase revenues is to extract more fees from sellers.

Perhaps as a consequence of financial underperformance, a co-CEO and several directors have left, and the company has hired 2 new C-level people, a former McKinsey exec as CEO and a People and Culture Officer. They also fired 60+ employees in 2023 and announced the new price structure on Sept 4.

My own takeaways about Chrono24’s business model are as follows:

Chrono24’s value is primarily in its position as a central marketplace with an escrow service and a great buyer’s search/seller’s listing function. It is by nature a rather low tech, low margin business. It does not have the profile of an innovative, technology driven disruptor that will IPO spectacularly. Chrono24 would probably add more value by maintaining a low cost, global marketplace with the largest number of recurring sellers and buyers. Pursuing a more minimalist strategy by eschewing attempts at front-end innovation and direct sales could be an option.

In the AI age, data is the new oil, and Chrono24 is effectively a centralized repository of niche transaction data. This transaction data is important, but currently the parameters are too basic; information derived from their data will result in error rates that make it irrelevant at a practical level and misleading at worst. This is primarily due to the difficulty of solving the heterogeneity problem as I wrote in my previous post. A focus on data optimization for monetization as a base data layer for analysis by 3rd parties (via an API) is probably more valuable in the long run than creating their own market data graphs or calculating optimal commission rates. In my previous post I also wrote about how a community based platform would help ameliorate the heterogeneity problem cost-effectively and allow for more accurate data inference by LLM’s.

As of the latest available financial statements (FY2022), Chrono24 was still selling inventory from their own book (The Watch Barn, formerly Xupes). If this is still continuing via direct sales and/or procurement dealing10, it could be perceived as a major conflict of interest with sellers on their platform. Imagine all your transaction information including pricing is transparent to a competitor, who can undercut you at any time.

Over the past decade, social media has taught us the importance of influencers and the individual expertise and personalities of sellers; It is why Eric Ku and Justin Gruenberg’s LoupeThis and Mike Nouveau’s Pushers.io are successful startups from scratch. Chrono24 seems to primarily focus on promoting its own Chrono24 brand, a strategy that sits awkwardly on social media. Perhaps they view their business model as akin to Amazon, and luxury watch sellers as comparable to drop-shippers. Redesigning their platform to a marketplace that promotes its sellers would have a larger positive financial impact than revenue extraction via fee hikes.

With the right focus, I think Chrono24 can put 2022 behind and continue to dominate the online luxury watch market to deliver strong value to sellers, buyers, and shareholders. I for one look forward to the new management team’s future plans.

Story is developing, stay tuned for Part 2.

Key word “may”, not sure about this.

Per Chrono24.com, “A commission fee is charged for every watch sold on our platform. We calculate each individual commission fee according to various criteria such as the brand, price, and condition of the watch. You can use our revenue calculator to determine the exact commission fee for each watch.” However it also seems to depend on the seller’s price bracket and seller type. Perhaps it is also based on analysis of historic transaction data and forecasts thereof. You can register as a professional seller on Chrono24 and use the calculator or contact your RM to get your commission rate.

Montro and Wristler are some other luxury watch sales platforms, but they pale in comparison to Chrono24 in terms of # of visitors and listings. For example, Montro claims to have 20,000+ watches from 199 sellers. Chrono24 has 580,000+ listings from 3000+ sellers. By the way, why aren’t there any US-based online luxury watch platforms?

TCI was operating in a highly regulated industry where competition for acquisitions was effectively limited.

From William Thorndike’s The Outsiders, via one of my favorite blogs, CommonCog

Financials for FYE2023 are still unavailable publicly.

The protection is one-sided; sellers are vulnerable to “never received it chargeback” frauds, which Chrono24 does not protect against.

Chrono24 was founded in 2003 but acquired by current Chairman Tim Stracke and partners in 2010. So almost 14 years since takeover.

€77M in operating expenses for the core fee business I calculated as: total €66.9M in operating expenses (of which €41.4M only in personnel costs, plus marketing/technology/administrative, minus Xupes/Direct expenses) plus approximately 50% of fulfillment expenses.

As of Sept 28, listings classified as “needs to be procured” or “available on request” made up 32% of the total 579,785 listings on Chrono24.com.

Exceptional post, thank you.